Hong Kong Tax Alert | The New Foreign-sourced Income Exemption Regime in Hong Kong

Nicolas Vanderchmitt

Marie-Gabrielle du BourblancCounselHong Kong

Marie-Gabrielle du BourblancCounselHong KongMarie-Gabrielle du Bourblanc

Hong Kong Tax Alert | The New Foreign-sourced Income Exemption Regime in Hong Kong

On 1 January 2023, the Inland Revenue (Amendment) (Taxation on Specified Foreign-sourced Income) Ordinance 2022, came into operation.

Under the new legislation, specified foreign-sourced income (namely dividends, interest, income derived from the use of intellectual property (“IP”) and equity disposal gains) generated by a multinational enterprise (“MNE”) carrying on an activity in Hong Kong are to be regarded as arising in or derived from Hong Kong and therefore chargeable to profits tax if and when they are received in Hong Kong unless the MNE entity has a sufficient economic substance in Hong Kong or meets alternative requirements (nexus requirement for IP income or participation requirement for dividends and equity disposal gains). Before the entry into force of this legislation, such foreign-sourced income was regarded as “offshore revenues” and were therefore exempted from profits tax in Hong Kong.

A foreign-sourced income is regarded as received in Hong Kong when:

- the income is remitted to, or is transmitted or brought into, Hong Kong;

- the income is used to satisfy any debt incurred in respect of a trade, profession or business carried on in Hong Kong; or

- the income is used to buy movable property, and the property is brought into Hong Kong. The income is regarded as being received at the time when the moveable property is brought into Hong Kong.

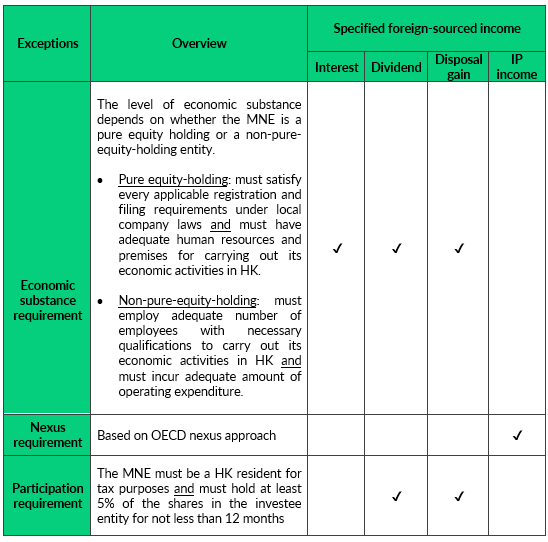

See below a table summarizing the requirements for each passive income to remain exempted from profits tax in Hong Kong:

This new regime does not apply to foreign-sourced income incidental to the business activities of regulated financial entities in Hong Kong.

Actions to consider: MNE groups currently lodging offshore claims should evaluate the impact arising from this new regime, including whether they can satisfy the conditions of the economic substance requirement, the nexus approach, or participation exemption so that their offshore passive income would remain exempt from profits tax.

Our tax team is available if you have any question.